NOAA Grants Management Division Budget Narrative Guidance

All applications must have a detailed budget narrative explaining and justifying the federal and the non-federal expenditures by object class category as listed on SF-424A – Section B (Budget Category) for non-construction awards (and the SF-424C for construction awards). For clarification and simplicity, it is best to discuss each expense by object class in the order that they appear on the SF424A. Include detailed descriptions of all cost justifications (see below for more detail). Additionally, provide any cost sharing and matching funds in the same level of detail as the federal funds. The budget narrative submitted with the application must match the dollar amounts on all required forms. Please explain each calculation and provide a narrative that supports each budget category (the SF-424 must equal total costs identified on the SF-424A form which must match the budget narrative).

Costs proposed to NOAA awards must be reasonable, allowable, allocable, and necessary to the supported activity. Refer to 2 CFR §200 for applicable administrative requirements and cost principles. The SF424 family forms can be accessed at Grants.gov. If your award is for multi-year or multiple year funding, you must provide a budget and budget justification for each year. Show each year in a separate column on the SF-424A and use a separate column for listing any match funds. NOAA expects that applicants will ensure that no Federal or non-Federal grant funds will be expended for in-kind goods or services, for purposes of providing transportation, travel, and other expenses for any Federal employee.

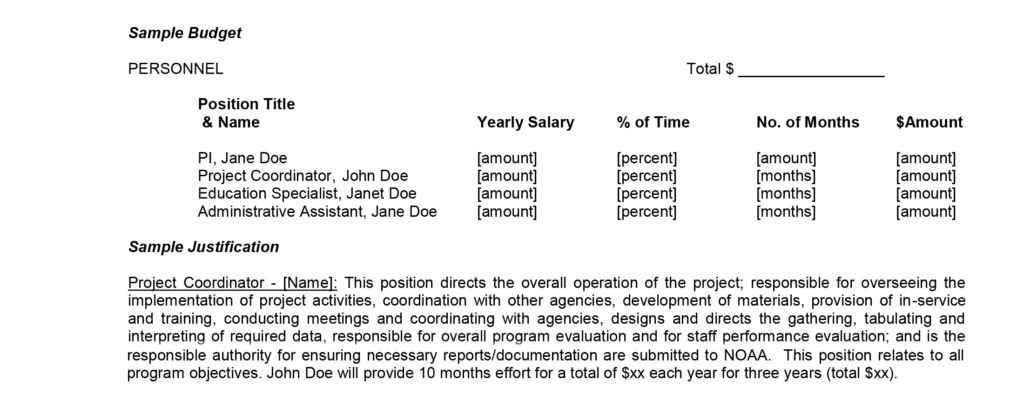

A. Personnel:

Provide the name of the person in each position (if known), and provide both the annual (for multiyear awards) and total: salary/amount each position is paid; the percent of time position contributes to this award; and the number of months the employee is paid. State if any positions are vacant at the time, and if so, anticipated hire date. Also, provide a justification and description of each position (including vacant positions). Relate each position specifically to program objectives. Personnel cannot exceed 100% of their time on all active projects. Recipient should ensure the cost of living increase is built into the budget and justified.

The salaries of administrative and clerical staff should normally be treated as indirect (F&A) costs (2 CFR §200.413c). Direct charging of these costs may be appropriate only if all of the following conditions are met: (1) Administrative or clerical services are integral to a project or activity; (2) Individuals involved can be specifically identified with the project or activity; (3) Such costs are explicitly included in the approved budget or have the prior written approval of the Grants Officer; and (4) The costs are not also recovered as indirect costs.

B. Fringe Benefits:

Fringe benefits are usually applicable to direct salaries and wages. Provide the fringe benefit rate used and a clear description of how the computation of fringe benefits was done. Provide both the annual (for multiyear awards) and total. If a fringe benefit rate is not used, show how the fringe benefits were computed for each position. The budget justification should be reflected in the budget description. Elements that comprise fringe benefits should be indicated. The fringe rate should be proportional among the federal and non-federal share categories. If a fringe rate is greater than 35%, a description and breakdown of the benefits must be provided unless a negotiated indirect cost rate agreement (NICRA) has been provided. If fringe benefits are not computed by using a percent of salaries, provide a breakdown of how the computation is done. The applicant should not combine the fringe benefit costs with direct salaries and wages in the personnel category.

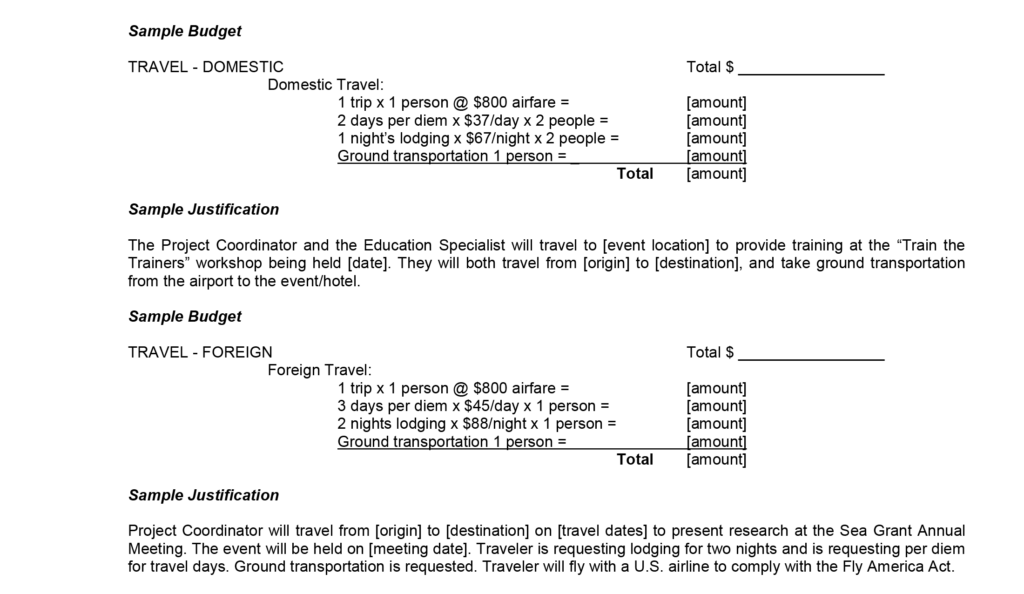

C. Travel:

Provide breakdown of travel costs as follows:

- Domestic Travel: Domestic travel includes travel within and between the U.S., the commonwealths of Puerto Rico and the Northern Mariana Islands, Guam, the U.S. Virgin Island, and the territories and possessions of the United States. Provide a narrative justification describing the travel staff will perform. List origin and destination, number of trips planned, who will be making the trip, purpose of travel and how it relates to the scope of work, and approximate dates. If mileage is to be paid, provide number of miles and the cost per mile. If travel is by air, show cost of airfare and proposed airline (if known). If per diem/lodging is to be paid, indicate number of days and the amount for each day’s per diem and the number of nights and the amount for each night’s lodging. Include any ground transportation when applicable. Total each trip planned.

- Foreign Travel: Travel outside the areas specified above is considered foreign travel. Provide a narrative justification describing the same information as above. Follow above format. Certify compliance with the Fly America Act. The Fly America Act limits the use of foreign flag carriers to foreign travel. A waiver is only allowed for specific instances and will require prior approval.

Dollars requested in the travel category should be for staff travel only. Travel for consultants should be shown in the consultant category along with the consultant’s fee. Travel for training participants, advisory committees, review panels and etc., should be itemized the same way as indicated above and placed in the “other” category. Travel should include: origin and destination, estimated costs and type of transportation, number of travelers, related lodging and per diem costs, brief description of the travel involved, its purpose, and explanation of how the proposed travel is necessary for successful completion of the project.

If travel details are unknown, then the basis for proposed costs should be explained (i.e., historical information). Travel costs can be charged on an actual basis, on a per diem or mileage basis in lieu of actual costs incurred, or a combination of the two if applied consistently and results in reasonable charges. Travel support for dependents of key project personnel may be requested only when the travel is for a duration of six months or more either by inclusion in the approved budget or with the prior written approval of the Grants Officer (2 CFR §200.474(c)(2)).

D. Equipment:

Provide justification for the use of each item and relate them to specific program objectives. Provide both the annual (for multiyear awards) and total for equipment. Equipment is defined as an article of tangible personal property that has a useful life of more than one year and a per-unit acquisition cost which equals or exceeds the lesser of the capitalization level established by the non-Federal entity for financial statement purposes, or $5,000. A recipient organization may classify equipment at a lower dollar value but cannot classify it higher than $5,000. For example, a state may classify their equipment at $1,000 with a useful life of a year.

It is recommended that internal policies for equipment are provided in this section in order to avoid requests by NOAA for closeout documents and delays during the closeout period.

General use of equipment (i.e., computers, faxes, etc.) must be used 100% for the proposed project if charged directly to the grant. Maintenance fees for equipment should be shown in the “other” category.

Provide a lease versus purchase analysis. This must accompany every equipment request over $5,000 even if a lease vs purchase analysis cannot be completed, a statement is required to that effect. General purpose equipment such as office equipment and furnishings, and information technology equipment and systems are typically not eligible for direct cost support (2 CFR §200.439).

Provide objective-related justification for all equipment items after the detailed budget. The source for determining the budget price for each unit of equipment should be included in the justification.

E. Supplies:

List by supply item. An explanation is necessary for supplies costing more than $5,000, or five percent of the award, whichever is greater. Show unit cost of each item, number needed, and total amount. Provide both the annual (for multiyear awards) and total for supplies. Provide justification of the supply items and relate them to specific program objectives. It is recommended that when training materials are kept on hand as a supply item, that it be included in the “supplies” category. When training materials (pamphlets, notebooks, videos, and other various handouts) are ordered for specific training activities, these items should be itemized and shown in the “other” category. If appropriate, general office supplies may be shown by an estimated amount per month multiplied by the number of months in the budget period.

Requirements for supplies which exceed the thresholds: explain the type of supplies to be purchased, or nature of the expense in the budget narrative; provide a breakdown of supplies by quantity and cost per unit if known; and indicate basis for estimate of supplies, i.e., historical use on similar projects.

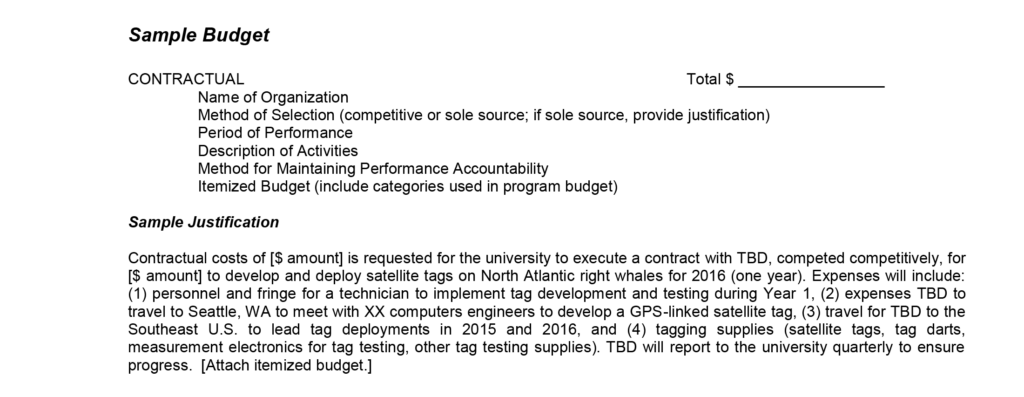

F. Contractual:

Provide separate budgets for each contract, regardless of the dollar value and indicate the basis for the cost estimates in the narrative. Describe products or services to be obtained and indicate the applicability or necessity of each to the project.

Please note the differences between contract, vendor, and subaward:

- Contract means a legal instrument by which a non-Federal entity purchases property or services needed to carry out the project or program under a Federal award.

- Vendor is generally a dealer, distributor or other seller that provides, for example, supplies, expendable materials, or data processing services in support of the project activities.

- Subaward means an award provided by a pass-through entity to a subrecipient for the subrecipient to carry out part of a Federal award, including a portion of the scope of work or objectives. It does not include payments to a contractor or payments to an individual that is a beneficiary of a Federal program. (It is recommended that subawards fall under the other section.)

Provide both the annual (for multiyear awards) and total for contractual. Do not incorporate contractual indirect costs under the indirect costs line item for the applicant/grantee on the SF-424A or budget narrative.

- Name of Contractor or Vendor: Include the name of the qualified contractor, affiliation, and contact.

- Method of Selection: Include how selection was made. If sole source, include an explanation. Include qualifications.

- Period of Performance: Include the dates/length for the performance period. If it involves a number of tasks, include the performance period for each task.

- Scope of Work: List and describe the specific tasks to be performed.

- Criteria for Measuring Accountability: Include an itemized line item breakdown as well as total contract/award amount. If applicable, include any indirect costs paid under the contract/award and the indirect cost rate used.

G. Construction:

Construction activity is allowable only when program legislation includes specific authority for construction and/or when the DOC operating unit specifically authorizes such activity. Activities under an award are considered construction when the major purpose of the award is construction as defined in this chapter. In contrast, alteration of facilities incidental to a non-construction purpose is not considered construction under this chapter.

Most federal programs do not allow construction costs, and those that do typically have detailed instructions describing how to figure construction costs. Estimated construction costs must be supported by documentation including drawings and estimates, formal bids, etc. As with all other costs, follow the specific requirements of the program, the terms and conditions of the award, and applicable regulations.

Whereas non-construction awards use the SF-424A form; construction awards must use the SF-424C form. Detail provided should include: administrative and legal expenses; land, structures, rights-of-way, appraisals, etc.; relocation expenses and payments; architectural and engineering fees, project inspection fees; site work; demolition and removal; equipment; contingencies; and program income.

H. Other:

This category contains both subawards and other items not included in the previous categories.

Subawards: Provide separate budgets for each subaward, regardless of the dollar value and indicate the basis for the cost estimates in the narrative. A subaward is an award provided by a pass-through entity to a subrecipient for the subrecipient to carry out part of a Federal award, including a portion of the scope of work or objectives. A pass-through entity is a non-Federal entity that provides a subaward to a subrecipient to carry out part of a Federal program.

Other: List items by type of material or nature of expense, break down costs by quantity and cost per unit if applicable, state the necessity of other costs for successful completion of the project and exclude unallowable costs (i.e., alcohol, fundraising, meals and coffee breaks). Provide both the annual (for multiyear awards) and total for other. Give justification for all the items in the “other” category (e.g., separate justification for printing, telephone, postage, rent, etc.).

All costs associated with training activities should be placed in the “other” category except costs for consultant and/or contractual. List all expenses anticipated for the training activity in the format above. Include rental space for training (if required), training materials, speaker fees, substitute teacher fees, and any other applicable expenses related to the training.

Allowable conference costs paid by the non-Federal entity as a sponsor or host of the conference may include rental of facilities, speakers’ fees, costs of meals and refreshments, local transportation, and other items incidental to such conferences unless further restricted by the terms and conditions of the Federal award. As needed, the costs of identifying, but not providing, locally available dependent-care resources are allowable. Conference hosts/sponsors must exercise discretion and judgment in ensuring that conference costs are appropriate, necessary and managed in a manner that minimizes costs to the Federal award (2 CFR Part 200.432). Furthermore, if such costs are unallowable by the recipient, they cannot be charged solely to the Federal award.

I. Total Direct Costs:

Show total direct costs by listing totals of each category.

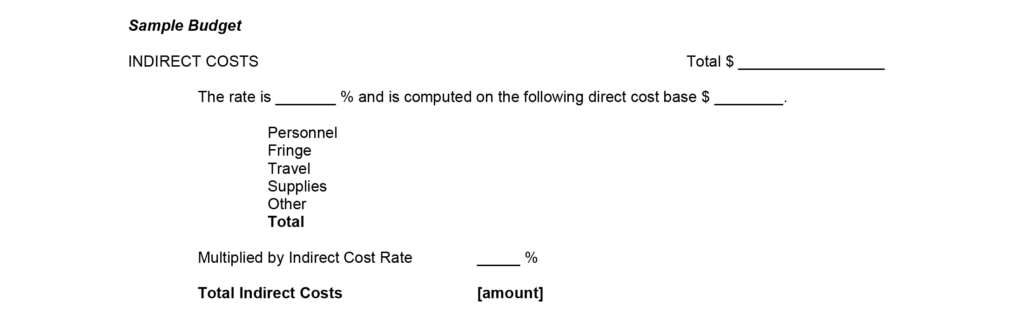

J. Indirect Costs:

Indirect costs are those costs incurred for common or joint objectives which cannot be readily identified with an individual project or program but are necessary to the operations of the organization. Please refer to the DOC Financial Assistance Standard Terms and Conditions and the 2 CFR 200 for more information about indirect costs and facilities and administrative costs, including more information regarding pre-determined, provisional, and fixed rates.

Provide the most recent indirect cost rate agreement with the itemized budget. The applicable indirect cost rate(s) negotiated by the organization with the cognizant negotiating agency must be used in computing indirect costs (F&A) for a proposal (2 CFR §200.414). The amount for indirect costs should be calculated by applying the current negotiated indirect cost rate(s) to the approved base(s).

Any non-Federal entity that has never received a negotiated indirect cost rate, except for those non-Federal entities described in Appendix VII to Part 200—States and Local Government and Indian Tribe Indirect Cost Proposals, paragraph (d)(1)(B) may elect to charge a de minimis rate of 10% of modified total direct costs (MTDC) which may be used indefinitely. Foreign grantees that do not have a negotiated indirect cost rate may also elect to charge the de minimis rate limited to an indirect cost rate recovery of 10% of modified total direct costs, and foreign grantees that have a negotiated rate agreement with a U.S. federal agency may recover indirect costs at the current negotiated rate.

(Only mandatory cost sharing or cost sharing specifically committed in the project budget must be included in the organized research base for computing the indirect (F&A) cost rate or reflected in any allocation of indirect costs.)

K. Total Direct and Indirect Costs:

Provide the total combined direct and indirect costs budgeted.

L. Cost Share/Match:

If a cost share/non-federal match is required for this award, demonstrate it meets the matching requirements. Provide sources of the match and provide adequate documentation for in-kind match. The match should provide the same level of detail as the federal share outlined in this guidance; therefore, it should be broken down by object class category (personnel, fringe, travel, equipment, supplies, contractual, other, indirect costs, etc.) The non-federal share is subject to the same regulations as the federal share. If the recipient cannot meet the cost share/match stated in its application, the Federal award should be reduced by the same percentage. (See reference under “J. Indirect Costs” regarding cost sharing and indirect (F&A) cost rate computation.)